Bookkeeping For Small Business

The Beginner’s Guide To Bookkeeping For Small Business

Bookkeeping for small business is a topic that many owners run away from. It’s a topic that seems extremely complex, but avoiding it leads to more trouble.

Therefore, this article will cover the basics of bookkeeping for small businesses while keeping things simple and easy to understand.

What Is Small Business Bookkeeping?

In simple terms, bookkeeping is the process of recording all the financial transactions of a business. This means keeping track of every penny that comes in (income) and every penny that goes out (expenses). Bookkeeping ensures a business has accurate and organised financial records, essential for understanding its financial health, making informed decisions, and complying with tax regulations. It’s about maintaining a clear and detailed history of a business’s money.

Bookkeeping vs Accounting

It’s common to hear “bookkeeping” and “accounting” used interchangeably, but they represent distinct, related functions. Here’s a breakdown of their key differences:

- Bookkeeping: The Recording Process

- Bookkeeping focuses on the day-to-day recording of financial transactions. This includes bookkeeping tasks like:

- Recording sales and purchases.

- Processing invoices and payments.

- Reconciling bank statements.

- Maintaining the general ledger.

- Essentially, bookkeepers ensure that all financial data is accurately entered and organised.

- Bookkeeping focuses on the day-to-day recording of financial transactions. This includes bookkeeping tasks like:

- Accounting: The Analysis and Interpretation

- Accounting takes the data provided by bookkeeping to analyse and interpret a business’s financial health. This involves:

- Preparing financial statements (e.g., income statements, balance sheets, cash flow statements and trial balance).

- Analysing financial data to identify trends and patterns.

- Providing financial advice and guidance.

- Handling tax planning and preparation.

- Accountants use their expertise to provide insights into the businesses financial position that help make informed decisions.

- Accounting takes the data provided by bookkeeping to analyse and interpret a business’s financial health. This involves:

However, today, we will focus on the bookkeeping side of things to keep things simple.

Why is Bookkeeping Important?

For a small business owner, bookkeeping is essential for several reasons.

In fact, there are countless, but if I had to describe why bookkeeping is important using one word, I would use the word: “Overview”.

Bookkeeping simply allows you to keep an overview of where your money is coming from and where it’s going to.

Businesses have a larger volume of transactions, and if you’re not keeping your books properly, you can quickly lose an overview.

Three ways you can use bookkeeping are:

- Catch Tax Deductions

- Income Statements For Loans

- Catch Financial Mistakes

Let’s talk about these in a little more detail.

1. Catch Tax Deductions

You often forget tax deductions, but they are something that you need to account for

As a result, you could be paying hundreds in additional taxes per year, which you otherwise could have deducted.

By ensuring you have an overview of what’s eligible for tax deductions, you can ensure that you definitely won’t miss any in the future.

Bookkeeping makes that a lot easier to ensure you are paying the correct tax.

2. Income Statements For Loans

In most cases, when you apply for a small business loan, you’re going to need more than bank statements.

The lenders will want to have a clear overview of the numbers inside of your business.

Lenders want to take calculated risks, so it’s important that you can show them a crystal-clear overview of how your business is doing.

Otherwise, you are unlikely to get any type of business loan. Again, bookkeeping makes this a lot easier.

3. Catch Financial Mistakes

This is a big reason why bookkeeping for small businesses is essential.

When you have transactions flowing every single day, it’s going to be extremely hard to keep an overview, let alone catch financial mistakes.

And, yes, financial mistakes do happen. Sometimes, invoices get paid twice, old subscriptions don’t get cancelled or you may have forgotten to charge a client.

If you’re bookkeeping, mistakes can still happen, but the difference is that you notice.

Getting Started With Bookkeeping For Small Businesses

Now that we have covered why bookkeeping is important, let’s look at how you can get started with bookkeeping.

Bookkeeping for small businesses is a little simpler than bookkeeping for enterprise businesses. Why?

Because there are fewer transactions, the fewer transactions, employees, assets, etc., in your business, the simpler keeping your financial records will be.

Let’s take a look at the steps you can take to start bookkeeping for your small business.

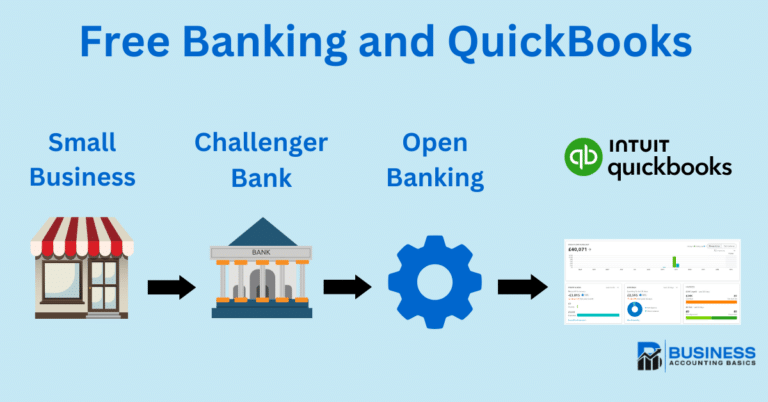

1. Separate Your Business & Personal Transactions

The first step you need to take is to separate your business & personal transactions.

This is a mistake some small businesses make, as they don’t separate their business bank account from their personal account.

Remember, bookkeeping is all about keeping an overview of where your money is going and coming from.

If you have hundreds of business transactions mixed with hundreds of your personal finances, it’s going to be hard to keep an overview and identify which transactions belong to your business.

So, before you move on to do any bookkeeping, separate your business account from your personal account. The easiest way to do this is to have a separate business bank account.

2. Choose your accounting Method

There are two different methods: the cash and accrual accounting methods. When you choose which accounting method you use, you must stick to it.

The easiest method is the cash method, as you enter the transactions as you spend or receive the cash.

The accruals method enters the transaction when it takes place. An example of this is a business that purchases stock. The business has the stock held on the balance sheet until it is sold. A transfer then takes place between the stock and the cost of goods sold on the income statement.

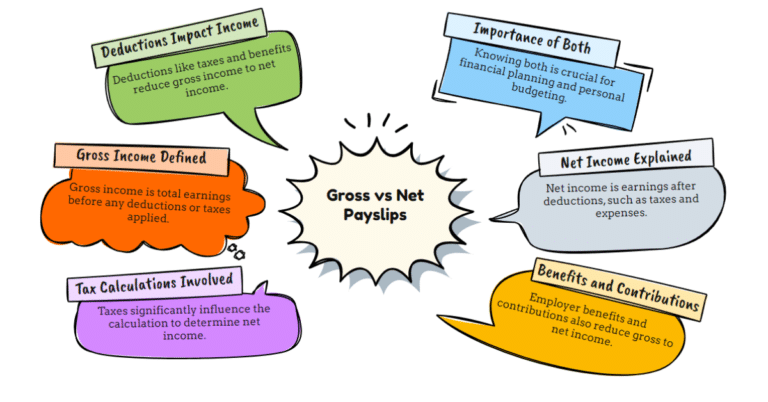

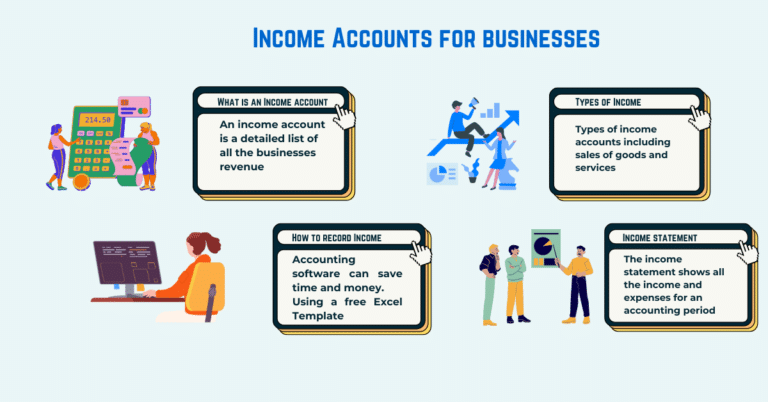

3. Prepare Financial Reports

The next step you need to take to start bookkeeping is preparing your financial reports.

Take a look and find any documents or bank statements that have any type of transaction related to your business.

This includes:

- Bank statements

- PayPal Statements

- Other payment processor statements

- Marketplace statements

- Tax Reports

I think you get the drill, anything with a transaction related to your business. Prepare these documents, as you will use them when keeping your business’s books.

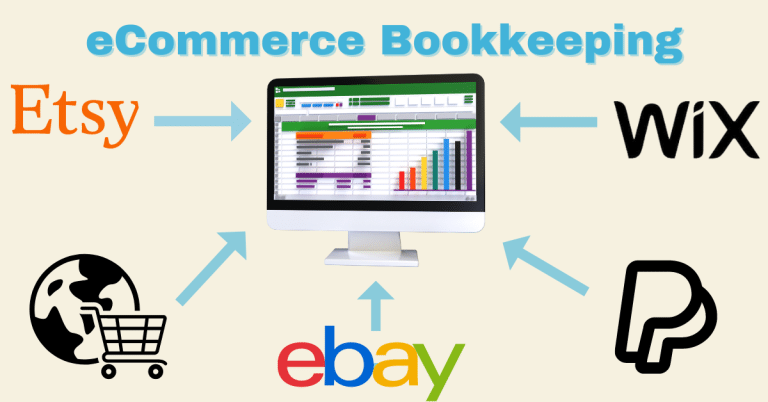

The easiest way to complete the bookkeeping and enter financial transactions is to use accounting software or Excel templates. The best bookkeeping software is XERO, or if you are looking for a free version, try Pandle.

4. Use Our Free Templates

Once you have ready all your statements and documents, it’s time to start finding the right templates that suit your business’s bookkeeping needs.

Don’t worry; you can get access to our free library of Excel bookkeeping templates.

Each spreadsheet has simple yet detailed instructions to help you keep your books correctly.

The templates range from cashflow forecasts to expense calculations, so you will surely find the best templates for your business.

5. Use Accounting Software

Using accounting software like QuickBooks and Xero can help reduce errors, save time, and produce the required reports. Here are the top reasons for using accounting software:

- Accurate Record Keeping (Double-Entry):

- Imagine every money move gets recorded twice, like checking your work. This is “double-entry” bookkeeping, built into accounting software. It helps catch mistakes and gives a clearer picture of your finances.

- Saves You Time:

- Instead of writing everything down by hand, the software does it for you. It handles invoices, tracking expenses, and balancing your bank accounts. This frees up your time.

- Automated Help:

- Accounting software has smart features that do a lot of the work. It can create reports, calculate taxes, and even manage your inventory. This automation makes things faster and reduces errors.

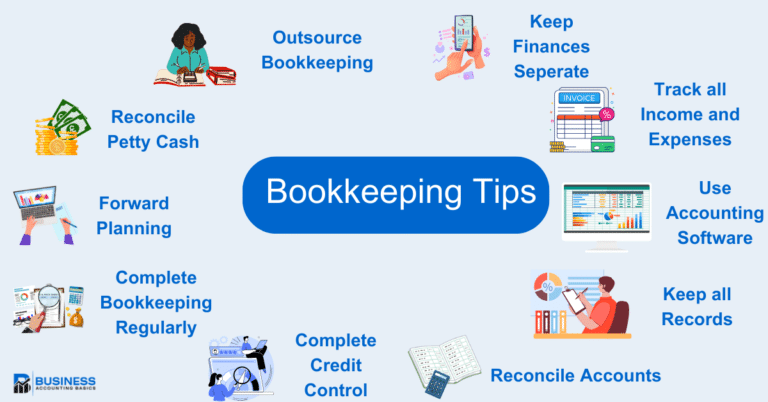

Stick To Your Schedule

Finally, once you are using our free bookkeeping templates for small businesses, you must stick to your schedule and update the books regularly.

How often should you update your books?

The more frequently, the better. You should aim to keep some sort of schedule, as this will make it easier for you to keep your books updated regularly.

If you have more daily transactions, you probably want to be a little more frequent with how often you update your books, as the more transactions there are, the harder it will be to keep an overview.

You could always play it safe and start by updating them every day, but if you notice it’s not needed, you can only update them once every two or three days.

FAQ About Bookkeeping For Small Businesses

Lastly, I also wanted to cover some frequently asked questions about bookkeeping for small businesses.

Do You Need To Hire a Professional?

It depends on the size of your business and how much time you are willing to invest in bookkeeping.

If you are a sole trader and don’t have a large volume of transactions, there may be no need to hire a professional. On the flip side, if your business is a little more complex and has a larger volume of transactions, you may want to consider working with a professional.

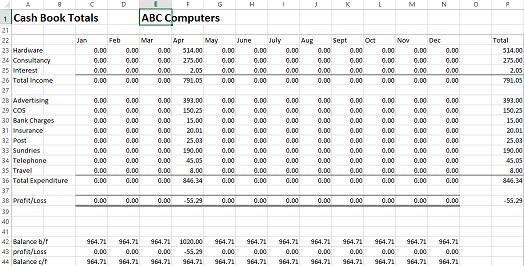

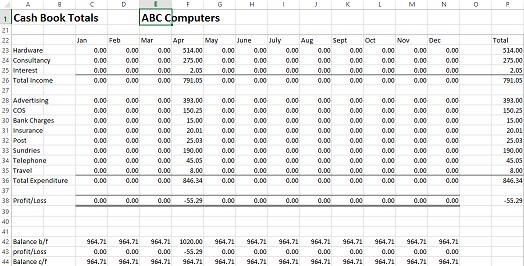

What Are Some Common Bookkeeping Templates To Use In Excel?

Here are 6 Common Bookkeeping templates to help keep track of your business finances:

- Accounts Payable – Track invoices owed to suppliers

- Accounts Receivable – Track sales invoices customers owe you

- Budget – Setting a budget is essential to keep on top of future spending

- Cash Book – To help keep track of income and business expenses

- Expenses – Used to claim sundry business expenses

- Cash flow forecast – Helps to predict future cash flow

You can find more accounting templates in our library.

Where Can I Learn Bookkeeping?

There are many free resources on the internet, including this website.

You can also check out our list of free bookkeeping courses.

Final Thoughts

As you have seen throughout this article, bookkeeping for small business owners doesn’t have to be as complex as some people make it sound.

However, it is something that you shouldn’t be avoided, as you may regret it in the future when you don’t have an overview of your business’s financial statements.

Take your time, use our free templates, and don’t overcomplicate them.

For further reading about bookkeeping for small businesses, read our bookkeeping basics section.